Georgia Deed Transfer Tax Exemptions . georgia law contains many exemptions to the state transfer tax, including transactions involving the following: if you're thinking about transferring property, you might be worried about the costs involved. In georgia, some sellers may be eligible for exemptions from state transfer taxes,. So, for the median home price of $333,862, the property transfer tax will. the current tax rate is $0.10 per $100 or 0.10% of the home sale value. exemption of certain instruments, deeds, or writings from real estate transfer tax; transfer tax exemptions. it is an excise tax on transactions involving the sale of real property where title to the property is transferred from the seller to. Requirement that consideration be shown.

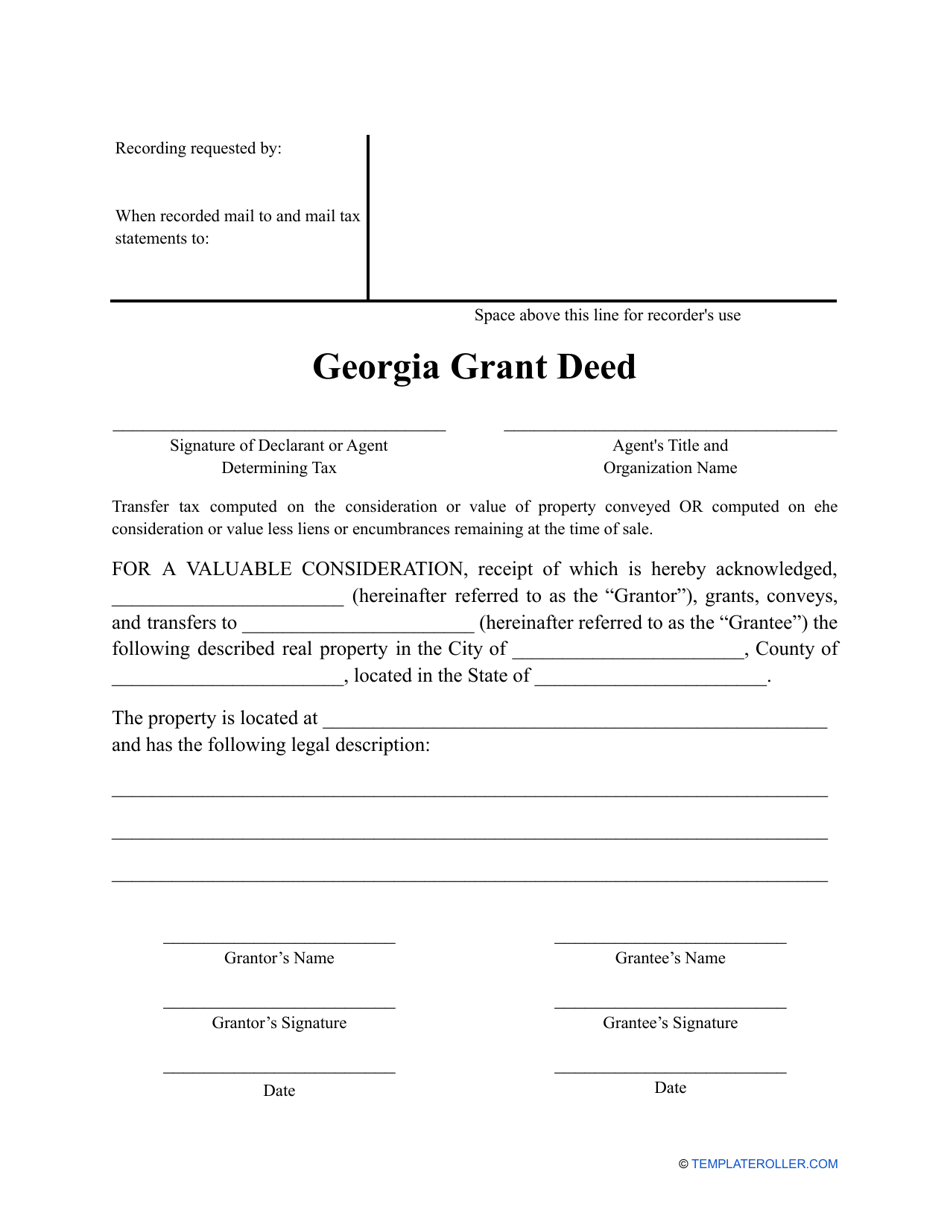

from www.templateroller.com

In georgia, some sellers may be eligible for exemptions from state transfer taxes,. Requirement that consideration be shown. it is an excise tax on transactions involving the sale of real property where title to the property is transferred from the seller to. if you're thinking about transferring property, you might be worried about the costs involved. transfer tax exemptions. the current tax rate is $0.10 per $100 or 0.10% of the home sale value. georgia law contains many exemptions to the state transfer tax, including transactions involving the following: So, for the median home price of $333,862, the property transfer tax will. exemption of certain instruments, deeds, or writings from real estate transfer tax;

(United States) Grant Deed Form Fill Out, Sign Online and

Georgia Deed Transfer Tax Exemptions if you're thinking about transferring property, you might be worried about the costs involved. exemption of certain instruments, deeds, or writings from real estate transfer tax; So, for the median home price of $333,862, the property transfer tax will. if you're thinking about transferring property, you might be worried about the costs involved. Requirement that consideration be shown. transfer tax exemptions. georgia law contains many exemptions to the state transfer tax, including transactions involving the following: In georgia, some sellers may be eligible for exemptions from state transfer taxes,. the current tax rate is $0.10 per $100 or 0.10% of the home sale value. it is an excise tax on transactions involving the sale of real property where title to the property is transferred from the seller to.

From www.signnow.com

St 5 20162024 Form Fill Out and Sign Printable PDF Template Georgia Deed Transfer Tax Exemptions Requirement that consideration be shown. if you're thinking about transferring property, you might be worried about the costs involved. georgia law contains many exemptions to the state transfer tax, including transactions involving the following: transfer tax exemptions. exemption of certain instruments, deeds, or writings from real estate transfer tax; the current tax rate is $0.10. Georgia Deed Transfer Tax Exemptions.

From www.dochub.com

How to transfer a deed after death in Fill out & sign online Georgia Deed Transfer Tax Exemptions the current tax rate is $0.10 per $100 or 0.10% of the home sale value. transfer tax exemptions. exemption of certain instruments, deeds, or writings from real estate transfer tax; So, for the median home price of $333,862, the property transfer tax will. georgia law contains many exemptions to the state transfer tax, including transactions involving. Georgia Deed Transfer Tax Exemptions.

From www.pdffiller.com

Deed Fill Online, Printable, Fillable, Blank pdfFiller Georgia Deed Transfer Tax Exemptions the current tax rate is $0.10 per $100 or 0.10% of the home sale value. exemption of certain instruments, deeds, or writings from real estate transfer tax; So, for the median home price of $333,862, the property transfer tax will. georgia law contains many exemptions to the state transfer tax, including transactions involving the following: In georgia,. Georgia Deed Transfer Tax Exemptions.

From uspatriottitle.com

Property Title Transfers to Family Guide to Legal, Financial, & Tax Georgia Deed Transfer Tax Exemptions the current tax rate is $0.10 per $100 or 0.10% of the home sale value. transfer tax exemptions. if you're thinking about transferring property, you might be worried about the costs involved. In georgia, some sellers may be eligible for exemptions from state transfer taxes,. georgia law contains many exemptions to the state transfer tax, including. Georgia Deed Transfer Tax Exemptions.

From thehardinlawfirm.com

Liens and Mortgages on Tax Deed Property The Hardin Law Firm, PLC Georgia Deed Transfer Tax Exemptions georgia law contains many exemptions to the state transfer tax, including transactions involving the following: In georgia, some sellers may be eligible for exemptions from state transfer taxes,. if you're thinking about transferring property, you might be worried about the costs involved. Requirement that consideration be shown. So, for the median home price of $333,862, the property transfer. Georgia Deed Transfer Tax Exemptions.

From www.exemptform.com

Ga Out Of State Tax Exempt Form Georgia Deed Transfer Tax Exemptions if you're thinking about transferring property, you might be worried about the costs involved. exemption of certain instruments, deeds, or writings from real estate transfer tax; In georgia, some sellers may be eligible for exemptions from state transfer taxes,. the current tax rate is $0.10 per $100 or 0.10% of the home sale value. Requirement that consideration. Georgia Deed Transfer Tax Exemptions.

From www.pinterest.com

Certified True Copies Of Titles And Documents Now Require Proper Georgia Deed Transfer Tax Exemptions the current tax rate is $0.10 per $100 or 0.10% of the home sale value. if you're thinking about transferring property, you might be worried about the costs involved. In georgia, some sellers may be eligible for exemptions from state transfer taxes,. georgia law contains many exemptions to the state transfer tax, including transactions involving the following:. Georgia Deed Transfer Tax Exemptions.

From legaltemplates.net

Free Oklahoma Quitclaim Deed Form PDF & Word Georgia Deed Transfer Tax Exemptions the current tax rate is $0.10 per $100 or 0.10% of the home sale value. So, for the median home price of $333,862, the property transfer tax will. In georgia, some sellers may be eligible for exemptions from state transfer taxes,. Requirement that consideration be shown. transfer tax exemptions. it is an excise tax on transactions involving. Georgia Deed Transfer Tax Exemptions.

From www.uslegalforms.com

DEED TO SECURE DEBT STATE OF Lexington National 20202022 Georgia Deed Transfer Tax Exemptions Requirement that consideration be shown. it is an excise tax on transactions involving the sale of real property where title to the property is transferred from the seller to. the current tax rate is $0.10 per $100 or 0.10% of the home sale value. In georgia, some sellers may be eligible for exemptions from state transfer taxes,. . Georgia Deed Transfer Tax Exemptions.

From eforms.com

Free Bill of Sale Forms PDF eForms Georgia Deed Transfer Tax Exemptions In georgia, some sellers may be eligible for exemptions from state transfer taxes,. if you're thinking about transferring property, you might be worried about the costs involved. it is an excise tax on transactions involving the sale of real property where title to the property is transferred from the seller to. the current tax rate is $0.10. Georgia Deed Transfer Tax Exemptions.

From cerxujcf.blob.core.windows.net

How To Find Old Property Deeds at Curtis Carroll blog Georgia Deed Transfer Tax Exemptions transfer tax exemptions. So, for the median home price of $333,862, the property transfer tax will. it is an excise tax on transactions involving the sale of real property where title to the property is transferred from the seller to. the current tax rate is $0.10 per $100 or 0.10% of the home sale value. In georgia,. Georgia Deed Transfer Tax Exemptions.

From www.exemptform.com

Sales And Use Tax Exemption Form Ga Georgia Deed Transfer Tax Exemptions In georgia, some sellers may be eligible for exemptions from state transfer taxes,. if you're thinking about transferring property, you might be worried about the costs involved. transfer tax exemptions. So, for the median home price of $333,862, the property transfer tax will. it is an excise tax on transactions involving the sale of real property where. Georgia Deed Transfer Tax Exemptions.

From www.signnow.com

Montgomery County Texas Homestead Exemption 20192024 Form Fill Out Georgia Deed Transfer Tax Exemptions So, for the median home price of $333,862, the property transfer tax will. if you're thinking about transferring property, you might be worried about the costs involved. Requirement that consideration be shown. georgia law contains many exemptions to the state transfer tax, including transactions involving the following: transfer tax exemptions. it is an excise tax on. Georgia Deed Transfer Tax Exemptions.

From www.templateroller.com

(United States) Transfer on Death Deed Form Fill Out, Sign Georgia Deed Transfer Tax Exemptions it is an excise tax on transactions involving the sale of real property where title to the property is transferred from the seller to. if you're thinking about transferring property, you might be worried about the costs involved. In georgia, some sellers may be eligible for exemptions from state transfer taxes,. georgia law contains many exemptions to. Georgia Deed Transfer Tax Exemptions.

From www.templateroller.com

(United States) Grant Deed Form Fill Out, Sign Online and Georgia Deed Transfer Tax Exemptions In georgia, some sellers may be eligible for exemptions from state transfer taxes,. georgia law contains many exemptions to the state transfer tax, including transactions involving the following: if you're thinking about transferring property, you might be worried about the costs involved. it is an excise tax on transactions involving the sale of real property where title. Georgia Deed Transfer Tax Exemptions.

From www.exemptform.com

Trust Transfer Deed Exemption Form Cook County Texas Georgia Deed Transfer Tax Exemptions So, for the median home price of $333,862, the property transfer tax will. In georgia, some sellers may be eligible for exemptions from state transfer taxes,. the current tax rate is $0.10 per $100 or 0.10% of the home sale value. if you're thinking about transferring property, you might be worried about the costs involved. it is. Georgia Deed Transfer Tax Exemptions.

From www.youtube.com

Tax Sales Redeemable Tax Deeds YouTube Georgia Deed Transfer Tax Exemptions Requirement that consideration be shown. So, for the median home price of $333,862, the property transfer tax will. it is an excise tax on transactions involving the sale of real property where title to the property is transferred from the seller to. exemption of certain instruments, deeds, or writings from real estate transfer tax; transfer tax exemptions.. Georgia Deed Transfer Tax Exemptions.

From exoavzrhj.blob.core.windows.net

Montgomery County Recorder Of Deeds Record Search at Jose Koga blog Georgia Deed Transfer Tax Exemptions Requirement that consideration be shown. the current tax rate is $0.10 per $100 or 0.10% of the home sale value. In georgia, some sellers may be eligible for exemptions from state transfer taxes,. it is an excise tax on transactions involving the sale of real property where title to the property is transferred from the seller to. . Georgia Deed Transfer Tax Exemptions.